In a world where financial transactions and documents are increasingly digitized, the need for robust fraud detection methods has never been more pressing. Financial documents—ranging from contracts and checks to loan applications and invoices—are integral to business and personal transactions. Unfortunately, they are also prime targets for forgery and manipulation. Forensic document analysis experts play a critical role in identifying authentic documents and detecting fraud, helping organizations and individuals protect themselves against potentially devastating financial crimes. This article explores the methods and tools used in fraud detection, common types of document manipulation, and the irreplaceable value of forensic experts in ensuring financial document authenticity.

The Rising Threat of Financial Document Fraud

Why Financial Documents Are Prime Targets for Fraud

Financial documents often contain sensitive information that can lead to monetary gain for fraudulent actors. With access to banking details, contract terms, or personal identification, forgers can manipulate financial outcomes to their advantage. Fraudulent activity in financial documents includes altered invoices, forged checks, and manipulated financial statements, which can cost businesses and individuals millions each year.

Digital technologies, while convenient, have also opened new avenues for fraud. High-resolution scanners, image editing software, and document manipulation tools make it easier for fraudsters to forge signatures, alter terms, or create entirely fictitious documents. Financial document fraud is evolving, and the need for skilled forensic document examiners is critical to combatting this threat.

Methods of Financial Document Forgery

Understanding the different ways financial documents can be manipulated is crucial for effective fraud detection. Here are some of the most common methods:

-

Signature Forgery

Forged signatures are frequently used to authorize fraudulent transactions. Criminals may attempt to imitate someone’s signature or use a digital copy to legitimize illegal activity.

-

Content Alteration

In cases where existing documents are altered, fraudsters may modify numbers, dates, or terms to change the nature of a financial agreement. For example, a loan document might be altered to reduce interest rates, increase loan amounts, or extend deadlines.

-

Counterfeit Documents

Fraudsters may create entirely new documents that appear to be legitimate. These can include falsified invoices, fabricated contracts, or fake bank statements. Advanced imaging software makes this process easier, allowing criminals to replicate logos, formats, and layouts with precision.

-

Photo Manipulation

Using photo editing tools, fraudsters can modify elements of scanned documents to remove original information or add new details. For example, they might alter pay stubs or identification numbers to create a false representation of a person’s finances.

Techniques Used in Financial Document Authentication and Fraud Detection

To counter these sophisticated methods of fraud, forensic document examiners employ a range of techniques designed to scrutinize document authenticity and identify signs of manipulation. Below are some of the most widely used techniques:

1. Signature Analysis

Signature analysis is essential in verifying the authenticity of signed documents. Forensic experts examine several characteristics, such as pressure, slant, and stroke sequence, to determine if a signature is genuine. According to studies on fraud detection (see Emerald Insight), even minor hesitations or tremors in a forged signature can reveal its inauthenticity.

2. Ink and Paper Analysis

Different inks and paper types can reveal a lot about a document’s history. For instance, a single document containing two types of ink could indicate that sections were altered after the original was signed. Forensic experts use microscopes and chemical analysis to detect discrepancies in ink, paper texture, or watermark, indicating possible tampering.

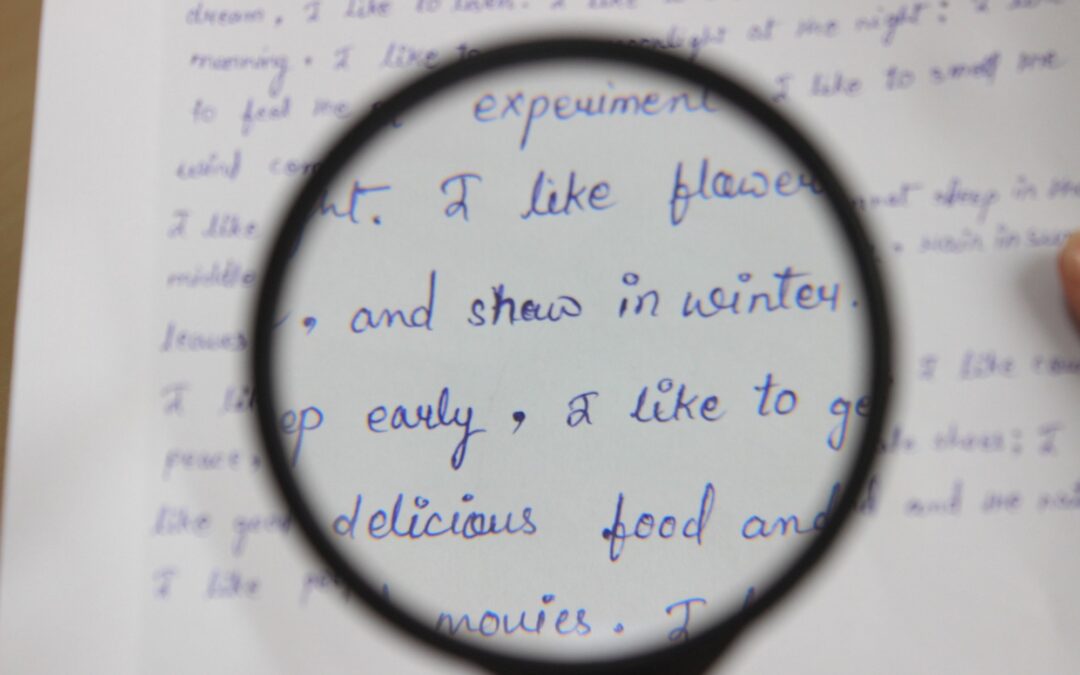

3. Image Comparison Software

Advanced software allows forensic examiners to compare scanned images of documents with remarkable precision. By analyzing pixel density, color patterns, and fine details, experts can detect if any part of a document has been altered. Software-assisted document comparison can be crucial in detecting edits that might be invisible to the naked eye (for more on this, see Docsumo’s Guide to Document Fraud Detection).

4. Analyzing Metadata in Digital Documents

In digital documents, metadata—such as creation dates, author information, and modification history—can provide insights into a document’s authenticity. Metadata analysis is particularly valuable for forensic experts working with PDFs and other digital formats, as it reveals whether a document has been altered since its original creation.

5. Text and Font Analysis

Examining fonts, font sizes, and letter spacing can reveal inconsistencies in manipulated documents. Fonts may not match in altered sections, or text may not align perfectly with the rest of the document. This type of analysis requires a keen eye and often benefits from automated software that detects even minute variations.

Real-Life Cases Where Forensic Document Analysis Made a Difference

Forensic document analysis has played a decisive role in numerous high-profile cases, reinforcing its importance in modern fraud detection.

The Enron Scandal and Document Authentication

During the Enron scandal, forensic document experts were called upon to authenticate critical financial documents. By examining handwriting and signatures on key documents, they were able to identify forged signatures and manipulated financial records. This authentication helped reveal fraudulent activities within the company, leading to greater accountability and a push for stronger financial regulations.

Fraud Detection in Mortgage Documents

Mortgage fraud cases often involve altered income statements, falsified tax documents, and forged signatures. In one case, forensic document examiners were able to identify inconsistencies in ink density and document alignment, proving that a critical mortgage document had been tampered with. Their findings were used in court to nullify the fraudulent mortgage agreement and helped prevent further losses.

The Value of Forensic Document Experts in Financial Fraud Cases

Objective, Scientific Evidence

Forensic document examiners provide impartial, scientific evidence that can influence legal decisions. Their findings are based on thorough analysis, and their expert testimony can help jurors and judges understand complex aspects of document fraud.

Essential for High-Stakes Transactions

Forensic document examination is often indispensable in cases involving high-value transactions, such as real estate sales, corporate acquisitions, or estate settlements. Fraudulent manipulation of documents in these contexts can lead to significant financial losses or legal complications.

Helping Prevent and Detect Future Fraud

By identifying patterns in fraud cases, forensic experts can help organizations and institutions develop stronger policies to prevent document fraud. Their insights contribute to better fraud detection systems and increased awareness of common tactics used by fraudsters.

How to Choose the Right Forensic Document Expert

If you suspect document fraud or need to verify the authenticity of a financial document, selecting a qualified forensic document examiner is essential. Look for professionals with experience in financial documents, certifications, and a solid reputation in the industry. Reputable experts often have experience testifying in court, which can be invaluable if your case proceeds to trial.

For further reading on fraud detection techniques and their applications, check out This Guide to Identifying Fake Documents and this in-depth analysis from Emerald Insight.

FAQ: Understanding Document Fraud Detection

What types of financial documents are most commonly forged?

Commonly forged financial documents include checks, invoices, loan agreements, contracts, and tax documents. These documents are often altered to benefit the fraudster financially or to misrepresent the financial state of a company or individual.

How do forensic experts detect a forged signature?

Forensic experts detect forged signatures by examining characteristics such as pressure, stroke sequence, and line quality. They use tools like magnifiers and digital comparison software to look for signs of hesitation, tremors, or other inconsistencies that indicate a signature is not genuine.

Can digital documents be analyzed for authenticity?

Yes, digital documents can be analyzed for authenticity. Forensic examiners use metadata analysis, image comparison, and text analysis to detect signs of manipulation in digital files. Metadata can reveal whether a document has been altered and provide details about its history.

What tools do forensic document examiners use in fraud detection?

Forensic document examiners use a range of tools, including magnifying lenses, microscopes, digital comparison software, and chemical tests for ink and paper analysis. Advanced software also helps detect subtle image manipulations and discrepancies in digital documents.

Why should I hire a forensic document examiner for my case?

Hiring a forensic document examiner can be invaluable for cases involving high-stakes transactions, legal disputes, or suspected fraud. Their analysis provides objective, scientifically-backed evidence that can strengthen your case and help uncover the truth behind disputed documents.

Financial document fraud continues to pose serious risks, but with the expertise of forensic document examiners, businesses and individuals can take a proactive stance in verifying document authenticity. From spotting forged signatures to analyzing digital alterations, forensic experts are crucial in maintaining the integrity of financial transactions in today’s world. Whether for personal protection or corporate security, investing in fraud detection services ensures that authenticity is safeguarded.

Do You Require A Forensic Handwriting Expert?

If you’re facing a situation where forensic handwriting analysis could make a difference, Brenda Petty’s expertise can provide clarity and evidence-based insights. Whether it’s verifying signatures, identifying document alterations, or providing expert witness testimony, Brenda’s thorough and reliable approach ensures you get the support you need. Reach out today to discuss your case and learn how forensic handwriting analysis can support your needs. Contact Brenda for a consultation or more information.